Tax season can feel overwhelming for small business owners—but it doesn’t have to be. With the right preparation, clear timelines, and digital tools, you can stay compliant, avoid penalties, and file with confidence.

Whether you’re a small business owner, employer, or self-employed professional, preparing early is the key to a smooth tax season. This guide walks you through a simple, step-by-step checklist to help you stay organized and stress-free.

Why Early Tax Preparation Matters for Small Businesses

Many tax issues stem from missing documents, forgotten deadlines, or last-minute filing. Preparing ahead of time helps you:

- Avoid IRS penalties and late fees

- Reduce errors in tax forms and payroll records

- Improve cash flow planning

- Save time and reduce stress during peak tax season

Early preparation also gives you time to spot discrepancies, correct mistakes, and seek professional advice if needed.

Step 1: Gather Essential Tax Documents

Start by collecting all necessary financial and payroll documents. Having everything in one place makes filing faster and more accurate.

Business Income Records

- Sales receipts and invoices

- Bank statements

- Payment processor reports (PayPal, Stripe, Square)

- Records of cash, check, and digital payments

Payroll and Contractor Documents

- W-2 forms for employees

- 1099-NEC forms for independent contractors

- Pay stubs and payroll summaries

- Employee and contractor details (names, addresses, SSNs or EINs)

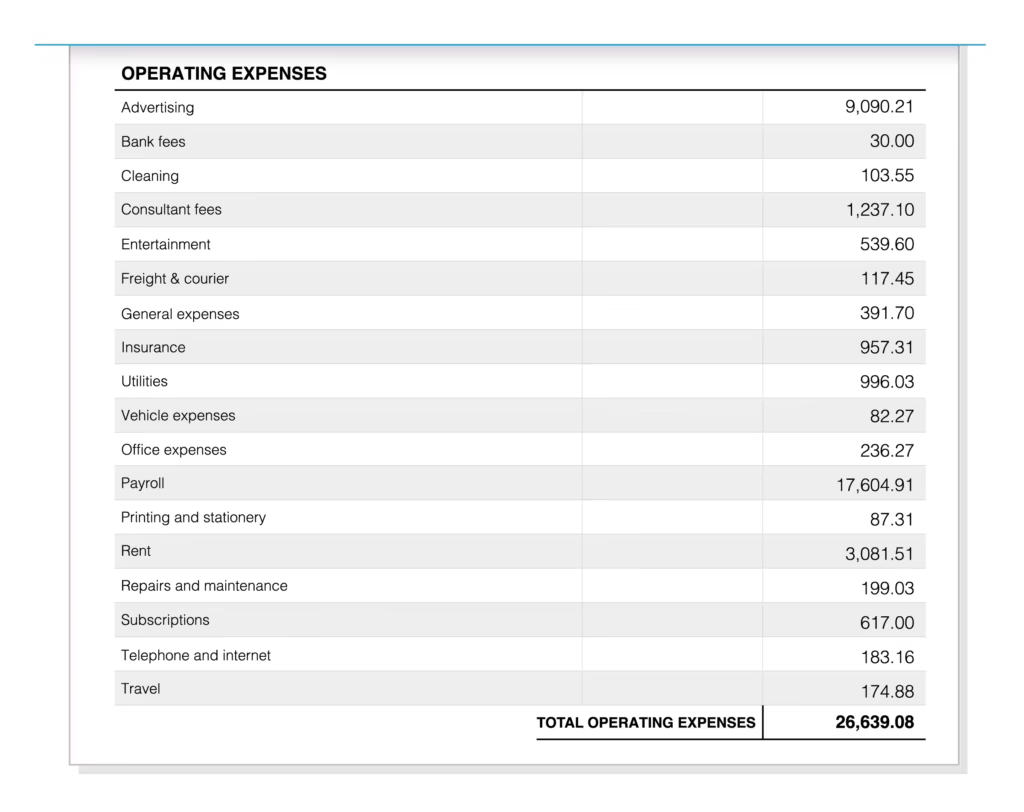

Expense and Deduction Records

- Business expense receipts

- Office supplies, utilities, and rent

- Travel and vehicle expenses

- Insurance and retirement contributions

Keeping digital copies of these records makes them easy to retrieve when needed.

Step 2: Know Key Tax Deadlines You Can’t Miss

Missing tax deadlines can result in costly penalties. Mark these important dates on your calendar:

- January 31 – Deadline to issue W-2s to employees and 1099-NEC forms to contractors

- January 31 – Deadline to file W-2s and 1099-NEC forms with the IRS

- March 15 – Business tax return deadline for partnerships and S corporations

- April 15 – Tax filing deadline for sole proprietors and individuals

- Quarterly estimated tax deadlines – April, June, September, and January

Staying ahead of deadlines helps prevent rushed filings and errors.

Step 3: Review Payroll and Tax Information for Accuracy

Before filing, double-check all payroll and tax records. Small mistakes can trigger IRS notices or delays.

Review the following:

- Employee classification (W-2 vs 1099)

- Names, Social Security numbers, and EINs

- Total wages, tips, and bonuses

- Federal, state, and local tax withholdings

Ensuring accuracy now saves time and frustration later.

Step 4: Use Digital Tools to Simplify the Process

Modern digital tools can dramatically reduce tax season stress. Small businesses benefit from using online solutions that automate calculations and recordkeeping.

Helpful digital tools include:

- Pay stub generators for accurate payroll records

- 1099 and W-2 form generators

- Cloud-based accounting software

- Secure document storage systems

Using digital tools helps ensure compliance, reduces manual errors, and makes record access easy year-round.

Step 5: Prepare for Estimated Taxes and Payments

If you’re self-employed or run a small business, estimated tax payments are essential. Review last year’s tax return to estimate your current tax liability and ensure you’ve made all required quarterly payments.

Planning ahead helps avoid underpayment penalties and unexpected tax bills.

Step 6: Keep Records Organized After Filing

Tax preparation doesn’t end once you file. The IRS recommends keeping tax records for at least three to seven years, depending on the document type.

Best practices include:

- Storing records digitally and securely

- Organizing files by year and category

- Backing up important documents

Staying organized year-round makes next tax season even easier.

Final Thoughts

Preparing for tax season doesn’t have to be stressful. By gathering documents early, tracking deadlines, reviewing payroll information, and using digital tools, small businesses can stay compliant and file with confidence.

A proactive approach saves time, reduces errors, and keeps your business running smoothly—no last-minute panic required.

Need help managing payroll records or creating accurate tax documents? PhcWorkHub offers simple tools to generate professional pay stubs, organize income records, and stay tax-ready all year long.