Understanding the difference between 1099 vs W-2 workers is essential for business owners, freelancers, and employees alike. Whether you’re hiring help, working as an independent contractor, or managing payroll for a growing company, knowing which tax form applies to you can prevent costly IRS mistakes and penalties. Misclassifying workers is one of the most common […]

Category Archives: Tax Forms

Discussions around tax reform often resurface during election cycles, and one proposal that has generated significant attention is former President Donald Trump’s idea of “no tax on overtime.” For hourly workers, salaried non-exempt employees, and employers running payroll, the concept raises important questions about take-home pay, payroll reporting, and compliance. In this article, we break […]

Tax season doesn’t have to be overwhelming. For many small business owners, stress comes from last-minute scrambling, missing documents, or uncertainty about deadlines. With the right preparation and a clear system in place, you can approach tax season with confidence instead of panic. This guide provides a simple, step-by-step tax season checklist for small businesses, […]

W-2 Filing Deadlines Explained: What Employers Must Do Before the IRS Deadline Every year, employers across the United States face the same critical responsibility: preparing and submitting W-2 forms accurately and on time. Missing the IRS W-2 filing deadline can result in penalties, frustrated employees, and compliance issues that are easily avoidable with proper planning. […]

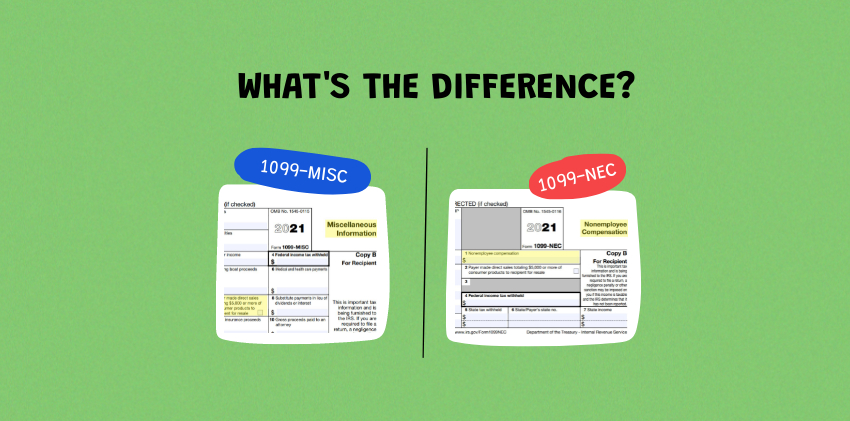

Understanding 1099 tax form deadlines is critical for business owners, freelancers, and employers who work with independent contractors. Each year, the IRS enforces strict timelines for preparing and submitting 1099 forms, and missing these deadlines can result in costly penalties. Whether you are issuing a 1099-NEC, 1099-MISC, or receiving one as a contractor, knowing when […]

As the new year approaches, many taxpayers begin asking the same question: when does income tax return filing begin in 2026? Whether you’re an employee, freelancer, independent contractor, or business owner, understanding the IRS tax filing start date helps you prepare early and avoid unnecessary stress. Each year, the Internal Revenue Service (IRS) announces the […]

A W-2 form is a yearly tax document issued by an employer that summarizes how much you earned and how much tax was withheld during the year. If you worked as an employee in the United States, you should receive a W-2 from every employer you worked for during that tax year. Knowing how to […]

Understanding Your W-2 Form: Deadlines, Box 12 Codes, Deductions & Online Access Every year, employees across the U.S. receive a W-2 form to help them prepare their taxes. If you’re wondering what does a W-2 form look like, when are W-2 forms sent out, or how to get W-2 form online, this guide covers everything. […]

1099 K: Meaning, Examples, Thresholds, and Tax Reporting Guide Tax reporting has become more complex in recent years, especially for freelancers, gig workers, and online sellers. One of the most asked questions is 1099 K what is it? Understanding the 1099 K meaning, the 1099 K tax rate, and the 1099 K reporting threshold 2025 […]

1099 NEC vs 1099 MISC: Complete Guide to 1099 NEC Meaning, Examples & Tax Filing When tax season arrives, many freelancers, contractors, and small businesses find themselves asking: 1099 NEC vs 1099 MISC – what’s the difference? Understanding the meaning, seeing a 1099 NEC example, and knowing how to use a 1099 NEC tax calculator […]

- 1

- 2