When you generate pay stubs, they’re more than just proof of how much you earned in each pay period — they’re a key part of maintaining financial transparency between employers and employees. However, these records aren’t meant to be kept forever.

Many people are unsure how long to keep pay stubs or what the legal requirements are. Some discard them too soon, while others store them indefinitely. These documents also come in handy for calculating W-2 wages during tax filing season.

While maintaining complete financial records is smart, it’s also important to know when and what to keep to avoid unnecessary clutter. In this article, we’ll break down how long to keep pay stubs, why they matter, and the best ways to store and organize them effectively.

Why Should You Keep Your Pay Stubs?

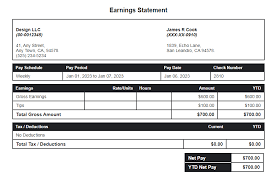

Your pay stub is much more than a slip showing what you earned — it’s a crucial financial document that summarizes your income, deductions, and taxes withheld. It provides an overview of your gross pay, net pay, tax deductions, hours worked, and pay rate.

These details are essential for filing taxes, verifying employment income, loan applications, rental agreements, and resolving wage disputes. A pay stub can also serve as proof of income for insurance or other claims.

Simply put, your pay stubs form a core part of your financial recordkeeping and help you track your earnings accurately.

How Long Should You Keep Pay Stubs Legally?

So, how long do you need to keep pay stubs legally? The answer depends on federal and state guidelines.

Federal Requirements

- IRS (Internal Revenue Service):

The IRS recommends keeping pay stubs for at least three years, mainly for tax filing and verification purposes. For employment tax records, keeping them longer is even better. - U.S. Department of Labor (DOL):

Under the Fair Labor Standards Act (FLSA), employers are required to maintain accurate payroll records, including hours worked, pay rates, and wage calculations, for a minimum of three years. Supporting documents such as timesheets must be kept for at least two years.

State Requirements

Each state has its own specific regulations for payroll record retention. As a general rule, it’s wise to keep pay stubs for at least one year after the tax year ends. Compare them with your W-2 form to ensure accuracy before discarding them.

For IRS audits or tax disputes, three years is a safe benchmark since most audits cover that period.

Some states also mandate that employers provide physical or electronic pay stubs, often requiring employee consent for digital delivery.

Situations Where You Should Keep Pay Stubs Longer

There are certain cases where holding onto your pay stubs longer is beneficial:

- Tax audits or disputes: Keep them three years after filing in case the IRS requests verification.

- Employment or wage claims: Retain them as proof of payment for at least three years.

- Loan or financial applications: Lenders may request two to three years of pay stubs as proof of income.

- Self-employed individuals or contractors: Keep stubs for three to six years for tax calculations.

- Digital records: Always verify that digital copies match your tax returns before deleting them.

- Hourly or non-exempt workers: Retain stubs showing total hours and overtime for a minimum of three years.

How Long To Keep Other Records Linked to Your Pay Stubs

When organizing pay stubs, don’t forget about related financial documents. Here’s a simple guide:

- W-2 forms and income tax returns: Keep for at least three years

- Receipts for major purchases or financial assistance: Three to seven years

- Bank statements showing payroll deposits: One to three years

- Benefit-related documents (retirement, HSA, insurance): Keep for as long as benefits are active

These supporting records complement your pay stubs and are useful during audits, disputes, or tax filing.

Should Employers Keep Employee Pay Stubs?

Yes — employers are legally required to retain employee pay stubs and payroll records under both federal and state laws.

According to the Fair Labor Standards Act (FLSA) and the IRS, employers must maintain:

- Payroll ledgers and time cards

- Copies of employee pay stubs

- Wage rate tables

- Payroll tax filings and wage computations

These records act as proof in case of wage disputes, audits, or tax compliance reviews. Employers can maintain either digital or paper copies, provided the data is accurate, secure, and easily retrievable.

How To Organize and Store Pay Stubs

Proper organization of pay stubs helps you stay compliant and reduces clutter. There are two reliable methods:

1. Digital Storage

Digital storage is one of the safest and most convenient ways to keep your payroll records. Many systems offer cloud backups and easy sharing options.

- Scan paper pay stubs into digital format.

- Use consistent file naming (e.g., “JohnDoe_July2025_PayStub”).

- Store in encrypted folders or secure cloud drives.

- Maintain multiple backups — one locally, one in the cloud.

- Retain records for at least three years.

- Protect files containing Social Security Numbers or bank details with passwords and two-factor authentication.

With tools like PHCWorkHub’s pay stub generator, you can create and manage digital pay stubs in minutes — staying compliant, accurate, and audit-ready.

2. Paper Filing System

If you prefer physical copies:

- Use clearly labeled folders for each year or employee.

- Arrange records chronologically or alphabetically.

- Keep W-2s and tax returns together.

- Once verified, shred old pay stubs from previous years to avoid clutter.

How To Destroy Old Pay Stubs Safely

Because pay stubs contain sensitive personal information (like Social Security numbers and salary details), they must be disposed of securely.

- Paper documents: Use a cross-cut shredder or certified shredding service.

- Digital records: Delete files permanently, then empty your recycle bin or trash folder.

- Always confirm that backup copies are no longer needed before deletion.

Wrapping Up

Now that you know how long to keep pay stubs, you can manage your financial documents more effectively and safely. Always check state-specific laws for accurate retention timelines, and securely dispose of records you no longer need.

By keeping organized pay stubs, you’ll have clear proof of income, simplify tax filing, and protect yourself from disputes.

Managing your records is effortless with PHCWorkHub’s Pay Stub Creator — a fast, professional tool that helps you generate accurate pay stubs online, stay audit-ready, and maintain clean, compliant records year-round.