1099 NEC vs 1099 MISC: Complete Guide to 1099 NEC Meaning, Examples & Tax Filing

When tax season arrives, many freelancers, contractors, and small businesses find themselves asking: 1099 NEC vs 1099 MISC – what’s the difference? Understanding the

meaning, seeing a 1099 NEC example, and knowing how to use a 1099 NEC tax calculator can save you from costly mistakes. At PHCWorkHub.com, we make it easy to access the right forms, learn best practices, and generate accurate tax documents.

What’s 1099 NEC? Understanding the 1099 NEC Meaning

The 1099 NEC meaning is simple: it stands for Nonemployee Compensation. This form is used to report payments of $600 or more made to freelancers, independent contractors, and other nonemployees.Why Was 1099 NEC Reintroduced?

Previously, nonemployee compensation was reported in Box 7 of the 1099 MISC. To reduce confusion, the IRS brought back the 1099 NEC form in 2020. Now:

- 1099 NEC = Nonemployee compensation (freelancers/contractors)

- 1099 MISC = Miscellaneous income (e.g., rent, prizes, royalties)

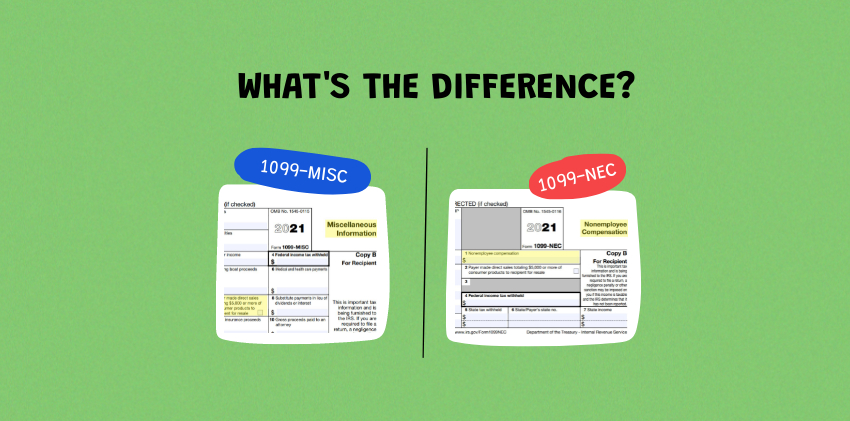

1099 NEC vs 1099 MISC – Key Differences

When to Use 1099 NEC

- Payments to independent contractors

- Fees for professional services

- Nonemployee commissions

When to Use 1099 MISC

- Rent payments

- Royalties

- Prizes and awards

- Medical and legal payments

Understanding 1099 NEC vs 1099 MISC ensures you report income correctly and avoid IRS penalties.

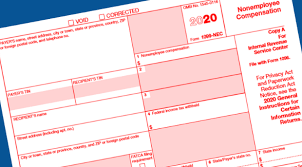

1099 NEC Examples – What They Look Like

A 1099 NEC example includes:

- Payer’s information (your business)

- Recipient’s name and Taxpayer Identification Number (TIN)

- Amount of nonemployee compensation paid

1099 NEC Examples in Real Life

- A freelance designer paid $1,200 for a project

- An independent consultant receiving $5,000 for services

- A contractor earning $800 for home repairs

These 1099 NEC examples show why it’s important to keep track of payments throughout the year.

How Much Tax on 1099 Income? Using a 1099 NEC Tax Calculator

A common question is: How much tax on 1099 income?

Independent contractors are responsible for paying:

- Self-employment tax (15.3%)

- Federal income tax (based on your tax bracket)

- State taxes (depending on your state)

Using a 1099 NEC tax calculator helps estimate your obligations so you can set aside money throughout the year.

Filing 1099 NEC on Your 1040 – Where Does 1099 NEC Go on 1040?

If you’re wondering where does 1099 NEC go on 1040, here’s the answer:

- Report income on Schedule C (Profit or Loss from Business)

- Pay self-employment tax on Schedule SE

This ensures all nonemployee compensation is correctly reported.

Which Copy of 1099 NEC Goes to Recipient?

- Copy B of the 1099 NEC goes to the recipient

- Copy A is filed with the IRS

- Copy C is kept by the payer for records

Where to Get 1099 NEC Forms

You can easily find where to get 1099 NEC forms:

- Order official forms from the IRS website

- Buy forms at office supply stores

- Or, the easiest way: use PHCWorkHub.com to download ready-to-fill IRS-compliant templates

Case Study – How Maria Simplified Tax Filing with PHCWorkHub

Background: Maria is a small business owner in New York who hires multiple freelancers throughout the year. She struggled to determine whether to issue a 1099 NEC vs 1099 MISC, and manual filing took hours.

The Problem:

- Confusion about what’s 1099 NEC

- Time wasted preparing forms manually

- Worry about IRS compliance

The Solution:

Maria switched to PHCWorkHub’s tax form tools. With access to 1099 NEC examples, an editable 1099 NEC form, and a built-in 1099 NEC tax calculator, she:

- Accurately generated forms for contractors

- Understood clearly which 1099 do I need

- Saved hours of administrative time

The Results:

- 70% faster tax form preparation

- Zero IRS penalties or rejections

- Peace of mind during tax season

Maria’s Words:

“Thanks to PHCWorkHub, I now understand 1099 NEC meaning and I never stress about 1099 NEC vs 1099 MISC again.”

FAQs About 1099 NEC vs 1099 MISC

What’s 1099 NEC?

The 1099 NEC reports nonemployee compensation such as freelancer or contractor payments.

Which 1099 Do I Need?

Use 1099 NEC for nonemployees and 1099 MISC for other income types like rent or prizes.

Where Does 1099 NEC Go on 1040?

Report it on Schedule C and Schedule SE for self-employment tax.

Where to Get 1099 NEC Forms?

From the IRS, office stores, or PHCWorkHub.com for instant downloads.

Why Choose PHCWorkHub for 1099 Forms?

- Access to 1099 NEC examples and guides

- IRS-compliant templates updated annually

- Built-in 1099 NEC tax calculator

- Easy online downloads for freelancers and businesses

Conclusion – Simplify 1099 Filing with PHCWorkHub

If you’ve ever wondered 1099 NEC vs 1099 MISC, or asked “what’s 1099 NEC?” PHCWorkHub has the answers. From 1099 NEC examples to a 1099 NEC tax calculator, we help you stay compliant and save time.

Visit PHCWorkHub.com today to learn how much tax on 1099 income, discover where to get 1099 NEC forms, and file with confidence. Make tax season stress-free with our professional tools.