W2 Documents and IRS-Compliant Form W2: Your Complete Guide to W2 Forms for 2025

Whether you’re an employee preparing for tax season or an employer handling payroll duties, understanding the W2 form is essential. The W2 documents issued annually to employees are one of the most critical parts of federal tax filing in the United States. If you’re searching for a reliable place to download, complete, or learn about the form W2, you’ve come to the right place.

At PHCWorkHub.com, we provide professionally designed, IRS-compliant W2 forms and guides to help you file accurately, quickly, and securely.

What Is a W2 Form and Why Is It Important?

The form W2, officially known as the Wage and Tax Statement, is an IRS form used by employers to report wages paid to employees and the taxes withheld. These W2 documents are essential for employees when filing federal and state income taxes.

Who Needs a W2 Form?

- Employers who pay an employee more than $600 annually

- Employees who receive wages, tips, or other compensation

Each employee must receive a W2 form by January 31 each year to prepare for tax filing.

Understanding the Components of a W2 Document

A W2 document contains detailed wage information that includes:

- Total wages earned

- Federal income tax withheld

- Social Security and Medicare taxes

- State and local income tax data

- Employer information

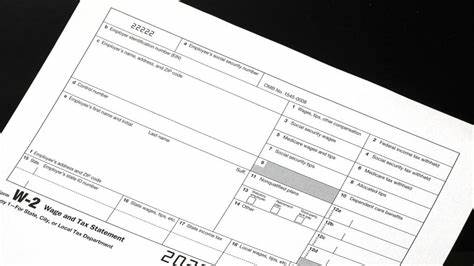

Key Boxes on the W2 Form

- Box 1: Wages, tips, and other compensation

- Box 2: Federal income tax withheld

- Box 3-6: Social Security and Medicare wages and withholdings

- Box 15-20: State and local tax information

Knowing how to read and verify your form W2 helps ensure accuracy in tax filing.

How to Get Your W2 Documents Online

Gone are the days of waiting for paper copies in the mail. With PHCWorkHub, you can:

- Download W2 forms instantly

- Access previous year W2 documents from secure cloud storage

- Generate and email digital W2s for easy sharing

Our platform ensures that every W2 form is IRS-compliant and ready for submission.

How Employers Use Form W2

As an employer, it’s your legal responsibility to:

- Complete a W2 form for each employee

- Submit copies to the IRS and SSA

- Provide copies to employees by the annual deadline

Save Time with PHCWorkHub’s W2 Generator

We offer a user-friendly W2 form generator that automates calculations and populates employee data securely. This ensures your business stays compliant and avoids penalties.

Case Study: How Sarah Automated W2 Filing Using PHCWorkHub

Background: Sarah owns a boutique marketing agency in Florida with 12 full-time employees.

The Problem:

At the end of every year, Sarah would manually create W2 documents, a process that took several hours and involved spreadsheets, form printing, and mailing.

The Solution:

Sarah started using PHCWorkHub’s digital form W2 tool. She:

- Uploaded her payroll data in bulk

- Auto-generated W2s with correct tax breakdowns

- Emailed secure copies to her team in minutes

The Results:

- Cut processing time from 2 days to 1 hour

- Improved accuracy and reduced stress

- Stayed compliant with IRS W2 filing deadlines

Sarah’s Feedback:

“PHCWorkHub’s W2 tool is a game changer. I don’t need a payroll specialist—I just log in, enter the data, and my W2 forms are done.”

Frequently Asked Questions About W2 Documents

When Will I Receive My W2 Form?

Employers must send out W2 documents by January 31 each year.

What Should I Do If I Haven’t Received My Form W2?

- Contact your employer or HR department

Can I File Taxes Without My W2 Form?

While it’s possible using Form 4852 as a substitute, the IRS strongly recommends using your actual W2 document.

What Happens If My W2 Has an Error?

- Notify your employer immediately

- Request a corrected form W2 (Form W-2c)

The Difference Between W2 and 1099 Forms

It’s important to distinguish between the W2 form and 1099 forms:

- W2: For employees—includes taxes withheld

- 1099-NEC: For independent contractors—no taxes withheld

If you’re working with both employees and contractors, PHCWorkHub offers tools for generating both types of documents.

Why Choose PHCWorkHub for W2 Forms?

- Instant Access: Download current or previous years’ form W2 documents.

- IRS Compliance: Our forms are regularly updated with the latest IRS standards.

- User-Friendly Interface: Easy for both employers and employees to navigate.

- Secure Storage: All W2 documents are encrypted and stored safely.

Whether you’re managing a growing team or filing taxes as an individual, PHCWorkHub is your trusted platform for all things W2.

Final Thoughts – Download Your W2 Form Today

Don’t wait until tax season becomes overwhelming. Visit PHCWorkHub.com to access your W2 documents, download the official form W2, and manage your filings effortlessly.

Make tax time stress-free with PHCWorkHub—your reliable source for professional W2 form tools and support.